Navigating the nonprofit sector can be complex. One crucial element is the Standard Industrial Classification (SIC) code, which helps classify and identify various nonprofit activities. These codes are used by government agencies to organize industry data.

Understanding the specific SIC code for a nonprofit organization is important. It streamlines compliance with regulations and improves data accuracy. Nonprofits can use SIC codes to better structure their activities and align themselves with industry standards.

Whether it's a local charity or a large foundation, having a clear SIC code classification allows for improved financial reporting and operational efficiency. This helps everyone from donors to regulatory bodies comprehend the scope and focus of the nonprofit's activities.

Key Takeaways

- SIC codes help classify nonprofit activities.

- Proper classification aids in regulatory compliance and data accuracy.

- Nonprofits benefit from clear SIC code identification.

Understanding Non-Profit SIC Codes

Non-profit SIC codes play a crucial role in categorizing and identifying various business activities specific to non-profit organizations. These codes help in organizing data, conducting research, and making informed decisions.

History and Definition of SIC Codes

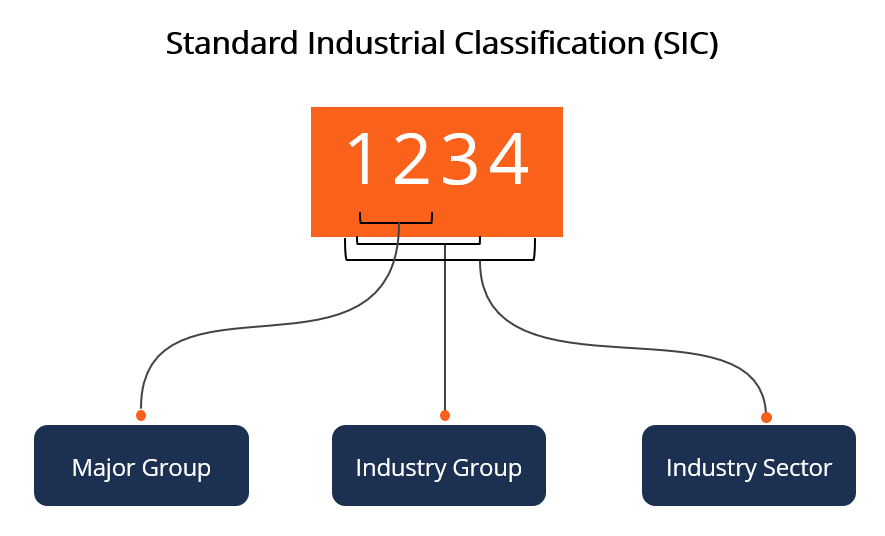

The Standard Industrial Classification (SIC) system was developed in the 1930s to classify various industries by a four-digit code. The purpose was to facilitate comparison and analysis of data across different sectors. This system has been widely used by government agencies, researchers, and businesses to analyze economic activities.

The SIC codes are divided into major groups and subgroups based on the type of industry. Each code provides a detailed definition that includes various business activities within the sector. Over time, they have become essential tools in both public and private sectors for various analyses and reporting requirements.

How SIC Codes Apply to Non-Profit Organizations

Non-profit organizations use SIC codes to classify their activities within the broader economic environment. Although the SIC system was initially designed for for-profit businesses, it also includes codes relevant to non-profits.

For non-profits, SIC codes help in categorizing activities such as health services, education, and charity work. These classifications aid in regulatory reporting, data collection, and funding allocation. For example, non-profit health services might fall under SIC code 80. Using these codes, non-profits can accurately report their activities and comply with legal requirements.

Additionally, SIC codes assist in research projects and policy-making by offering a structured way to analyze non-profit activities. This structured approach ensures that non-profits are effectively integrated into broader economic analyses.

The Role and Impact of Non-Profits in Key Sectors

Non-profits play a crucial role in various sectors like social services, education, and advocacy. They help improve communities, support those in need, and drive important social changes.

Social Services and Community Development

Nonprofits in social services and community development are vital in addressing local issues. They often focus on antipoverty programs, providing food, shelter, and healthcare to low-income families. Community improvement projects frequently include building affordable housing and offering job training programs.

Community development groups also work to enhance local infrastructure and create public spaces. These organizations play a key role in fostering economic growth and improving quality of life. They often operate under specific SIC codes that highlight their focus on social welfare and community support.

Educational, Charitable, and Religious Trusts

Educational trusts focus on expanding access to quality education. They provide scholarships, fund low-cost private schools, and support after-school programs. Charitable trusts often engage in a wide range of activities, from disaster relief to healthcare initiatives.

Religious trusts typically support community chest programs, which aid in housing, education, and healthcare. They also play a crucial role in spiritual and moral education, offering counseling and support services. These trusts are critical for sustaining community-based initiatives that enhance overall well-being.

Advocacy Groups and Political Organizations

Advocacy groups are dedicated to promoting social justice and policy changes. They work on issues like human rights, environmental protection, and public health. These groups often conduct research, engage in lobbying, and raise public awareness to influence policy decisions.

Political organizations, including advocacy groups, focus on specific causes and can mobilize public opinion. They are instrumental in pushing for legislative changes and holding governments accountable. Their impact is seen in the enactment of laws and policies that reflect important social values and priorities.

Practical Guide to Non-Profit Operations

Running a non-profit involves effective management of both fundraising activities and financial resources. Ensuring compliance with legal standards and strategic planning is crucial.

Fundraising and Soliciting Contributions

Non-profits can raise funds through various methods such as philanthropic trusts, grants, and events. Fundraising organizations should identify potential donors and build relationships with them.

Online campaigns and social media are effective tools to reach a broader audience. Clear communication of the non-profit's mission and impact is essential in soliciting contributions. Using email marketing and newsletters keeps donors informed and engaged.

Regular fundraising events like galas, auctions, or community gatherings can create significant revenue. It is important to adhere to local regulations regarding solicitation permits and tax-exempt status.

Managing Non-Profit Revenue and Finances

Non-profit financial management involves tracking revenues from contributions, grants, and other activities. Creating a detailed budget helps in planning and allocating resources.

Utilizing accounting software specifically designed for non-profits ensures accurate financial records. It is also critical to comply with the Standard Industrial Classification (SIC) codes to categorize activities correctly. Regular financial audits and transparent reporting maintain trust with donors and regulatory bodies.

Setting up a finance committee can enhance oversight and strategic financial planning. Ensure that all revenue is used according to the non-profit's mission and in compliance with donor restrictions.

For further details on non-profit accounting practices, you might want to check out this nonprofit management guide.